Cash Only July

Hello all! Happy August!

August is pretty low on the totem pole when it comes to favorite months. I don’t like the feeling of summer winding down, heading back to school, and cooler weather. I’m trying not to dwell on the changing seasons and instead focus on the here and now, which includes soaking up summer by getting outside and enjoying the little things in life like ice cream runs!

That being said, I’m looking forward to this weekend as my family and I will be getting away for a few days which will be fun to reconnect at one of our favorite spots.

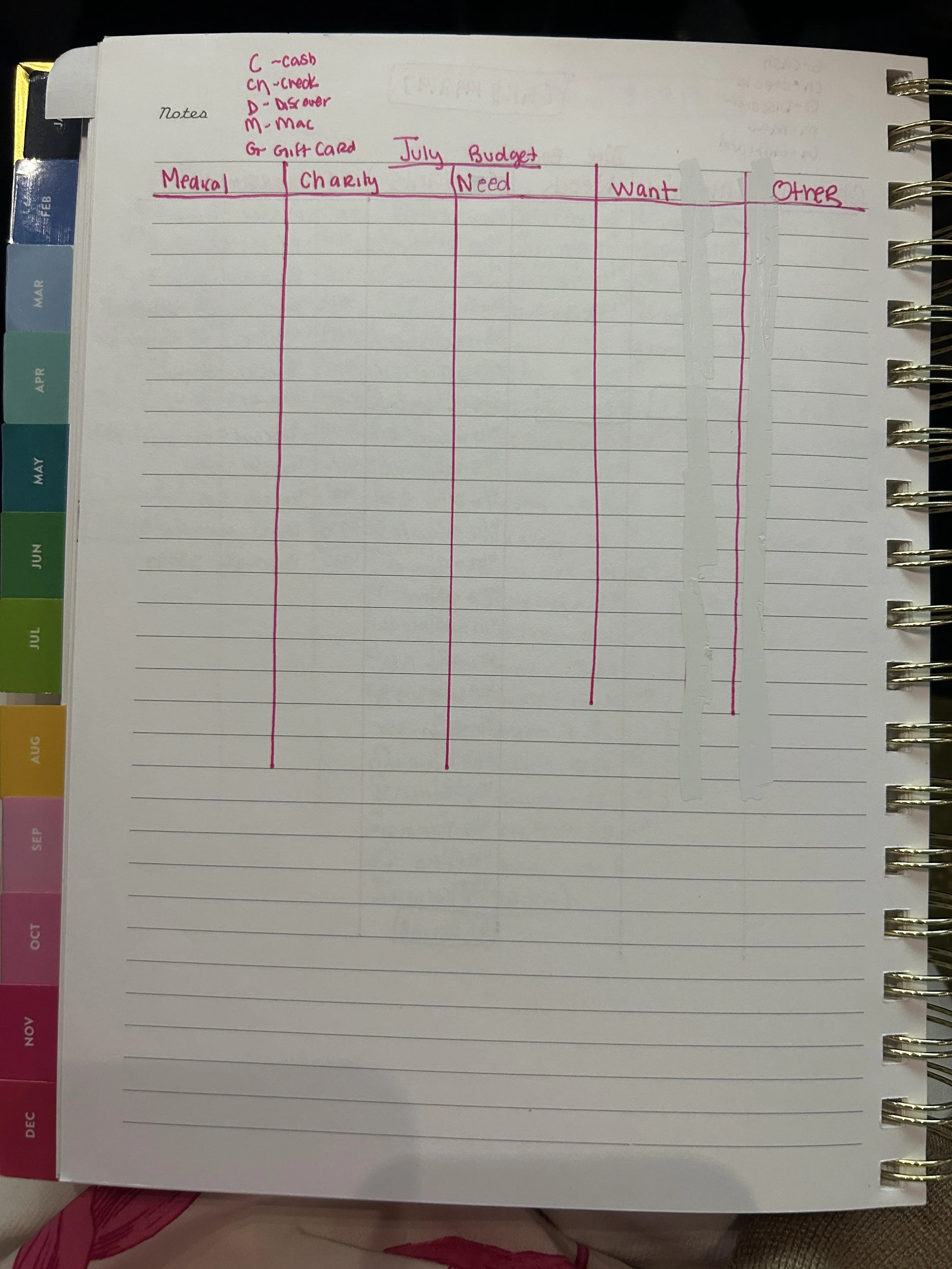

Today, I wanted to share a challenge that my fiancé and I committed to for the month of July. We tried to go the whole month to only pay for things with cash. We are both budget conscious people and wanted to take things to the next level by seeing how much we buy that’s a need versus a want. We tried to hold each other accountable and only found ourselves in a few situations where we had to pay with something using a debit or credit card.

Here’s how we did it:

At the beginning of the month we both took out cash and vowed to use that until we needed to replenish it. Over the course of the month, I took note of where and what I was spending my cash on. At the end of the month we compared roughly on what and where we spent our cash on.

I found myself spending the most on gas, doctors/ medicine and then some necessary items. I tried my best to limit my eating out and spending money on frivolous items due to our challenge. This really showed me how much little things really add up. I found myself asking the question “Do I really need this?”, oftentimes the answer was no.

By only using cash, I found myself doing a lot more mental math making sure I had enough cash to cover what I wanted to buy. I also found myself using change and counting it out exactly.

There were a few times where I had to pay with a credit or debit card, mostly with online payments that are automatically taken out. There was a time or two when I was shopping for someone else and had to use my credit card since I knew I didn’t have enough cash to cover the cost. But every time I got gas (which I had to do the old fashioned way, by going inside and asking them to put a certain amount on my pump), went to a doctor’s appointment, out for a meal, or even gave to church, I paid cash. It certainly made me think a lot more before I spent and how much I wanted to spend.

Overall, I think this was a good challenge and it really forced us to realize where our money was going. I found myself asking “Is this a need or a want?” It also showed me how you don’t think twice about using Apple Pay or putting something on a credit card, but it can be much harder to do that with cash involved.

I’m glad we committed to the challenge and made it through. Will we do it again? I’m not sure, but it was fun to keep track of expenses and definitely made me more aware of how I spend my money and it will be a good reminder moving forward if some purchases are really worth it.

I’m always curious about budgeting and finance. Do you have any hacks or ideas for conscious spending? I’m always open to hearing new ideas.

Have a great rest of your week and I’ll see you on Friday!